- Home

- Views On News

- Mar 11, 2024 - The Indian Aviation Industry is Booming and this Adani Stock Could be a Big Winner

The Indian Aviation Industry is Booming and this Adani Stock Could be a Big Winner

India is set to become the world's third-largest air passenger market by 2030, after China and the US, as per the International Air Transport Association (IATA).

The aviation market, estimated at US$ 13.5 billion (bn) in 2024, is projected to reach US$ 23.2 bn by 2029, implying a compounded annual growth rate (CAGR) of 11.4% during 2024-2029.

No nation in the world is buying as many aeroplanes as India. The country's largest airlines have ordered nearly 1,000 jets this year, committing tens of billions of dollars to a spending spree unparalleled in aviation.

The bulk of the growth of Indian aviation has been among homegrown airlines, which have clocked a 36% increase in passengers since 2022.

Air India has been adding Airbus aeroplanes to its fleet, a game-changer for the aviation sector.

The A350, known for enhancing long-distance travel, reflects Air India's dedication to modernisation, elevating the airline's global presence while setting a new standard for the industry.

The Impending Passenger Boom

According to India Brand Equity Foundation (IBEF), a Trust established by the Department of Commerce, India's passenger traffic grew from 137.5 million (m) in financial year 2022 to 160 m in financial year 2023 and is expected to reach 350 m by financial year 2030.

The massive transformation will be led by the rising working group, widening middle-class demography and significant infrastructure investments.

The growth in passenger traffic will give rise to the enhanced requirement for large service-driven airports, transforming them from mere connectivity hubs to urban development (metropolis) nodes.

According to Airbus, India will be the fastest-growing aviation market, with an investment of US$ 12 bn set to be poured into ramping up airport infrastructure. India has set a target to hit 200 airports by 2030 from the existing 149.

India's six key metropolitan cities are expected to increase their passenger handling capacity to 320 m per year, with a further expansion expected to 500 m per year.

Airport Expansion to Accommodate Surge

Four new airports and four new terminals have opened since November 2022. That gives India 149 operational civil airports, twice the number it had a decade ago. Nine additional airports have been approved and many more are planned.

Major airports in Delhi, Bengaluru, Chennai and Kolkata, along with the upcoming Noida International Airport and Navi Mumbai International Airport are expected to be a part of expansion projects.

The government aims to develop all six metros as major international hubs for air travel.

Government Initiatives Driving Growth

The government is actively fostering this growth through its UDAN scheme, to develop 100 new airports by 2024 and operationalize 1,000 regional routes.

The Indian Government is planning to invest US$ 1.83 bn for the development of airport infrastructure along with aviation navigation services by 2026.

The expansion of Indira Gandhi International Airport is underway, with a target to accommodate 109 m passengers by next year.

It is poised to claim the title of the world's second busiest airport, trailing only Hartsfield-Jackson Atlanta International Airport in the United States.

With the right policies and a focus on quality, cost and passenger interest, India is well-placed to achieve its vision of becoming the third-largest aviation market by 2024.

Where the Adani Group Fits in India's Aviation Sector

Adani Airport Holdings, with an integrated airport network comprising seven operational brownfields and one under-construction greenfield airport, is well poised to be a huge beneficiary of this boom.

Housed under the conglomerate behemoth Adani Enterprises, the airport business is identified as a new-age industry by the company.

Presently, the company oversees 23%+ passenger traffic in India and is poised to manage and develop these airports for 50 years.

In financial year 2023, the company achieved pre-Covid level performance. Passenger movement reached 74.8 m during the year across seven operational airports. The construction of its greenfield airport in Navi Mumbai remained ahead of schedule.

Looking ahead, Adani Airport Holdings looks to serve 300+ m consumers through airport infrastructure.

So far, in the first nine months of financial year 2024, the company has handled 65 m passengers (up 23% YoY), added 19 new routes 9 new airlines 5 new flights Navi Mumbai project is on schedule.

Taking Off in a Booming Market

Recently, Karan Adani, managing director of Adani Ports and Special Economic Zone revealed the group's plans to invest in the airport business.

The group aims to invest around Rs 600 bn in expanding its current portfolio of seven airports over the next 5-10 years.

Half of the investment will go towards enhancing terminal and runway capacity within the next five years, while the remainder towards city-side development over a decade.

This new investment plan complements the Rs 180 bn earmarked for the Navi Mumbai airport's Phase-I development, expected to commence operations by March 2025.

These massive investments will be funded from the internal accruals of the parent company, Adani Enterprises.

At present, the group's focus is on operationalising the Navi Mumbai airport and initiating city-side development across its airport portfolio.

Looking ahead, the Adani Group aims to more than double its airport capacity by 2040, with phased expansions in place.

Furthermore, the group envisions airports in smaller cities emerging as international passenger hubs, bypassing traditional metro hubs and offering direct connectivity worldwide.

Given Adani Enterprises' proven track record of nurturing new business interests into significant and self-sustaining entities, the IPO of Adani Airports may not be far behind.

The conglomerate is known for spinning off its businesses, listing these expandable units independently. So far, it has successfully incubated and listed six companies.

With plans already in motion for five more upcoming Adani IPOs, including Adani Airport Holdings, the group's Chief Financial Officer has disclosed that these subsidiaries are slated to enter the market between 2026 and 2028.

The company reports its revenues and operating profit under two primary segments - new and incubating.

The incubating business comprises of airports, roads, data centres and renewable energy (including green hydrogen).

The established business comprises primary industries such as the IRM, commercial mining, and mining services.

Adani Enterprises - Revenue Snapshot (9M FY2023-24)

| 9MFY24 | 9MFY23 | YoY% | |

|---|---|---|---|

| Revenue (Rs m) | 7,77,300 | 10,64,590 | -27.00% |

| Established business | 6,06,630 | 9,75,860 | -37.80% |

| % of total revenues | 78.00% | 91.70% | |

| Incubating business | 1,70,670 | 88,730 | 92.30% |

| % of total revenues | 22.00% | 8.30% |

Adani Enterprises - Operating Profit Snapshot (9M FY2023-24)

| 9MFY24 | 9MFY23 | YoY% | |

|---|---|---|---|

| Operating Profit (Rs m) | 11,46,530 | 6,95,360 | 58.10% |

| Established business | 9,75,860 | 6,06,630 | 33.00% |

| % of total revenues | 85.10% | 87.20% | |

| Incubating business | 1,70,670 | 88,730 | 104.80% |

| % of total revenues | 14.90% | 12.80% |

Funding the Flight Path

According to earlier market reports, the company plans to raise funds externally to fund its expansion as Adani's leveraged balance sheet could be the only roadblock to its ambitious plans.

Over the years, the conglomerate's constant expansion has led to increased borrowings. As of first half of financial year 2024, the debt-to-equity ratio stood at 0.62x.

According to the fund raising plan, the conglomerate plans to fund a fifth of the US$ 70 bn investment from internal accruals and balance from a prudent mix of foreign direct investments, loans and bonds.

The company aims to raise funds through a public offering, preferential allotment, including a qualified institutions placement (QIP), or other eligible securities issuance, with reports suggesting a share offering valued at least US$ 1.8 bn.

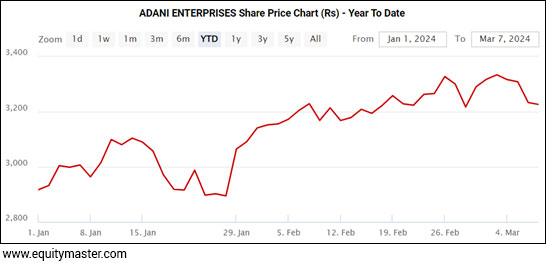

Since the beginning of 2024, Adani Enterprises has been on an upward trend, moving up from Rs 2,917 to Rs 3,222 at present.

Adani Enterprises Share Price in 2024

At the current market price of Rs 3,222, the stock is trading at a PE of 97.6 times, a minor discount to its 5-year median PE of 102.8 times.

To know more about the company, check out its financial factsheet and latest financial results.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "The Indian Aviation Industry is Booming and this Adani Stock Could be a Big Winner". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!